What Is Debt Consolidation And Is It A Good Idea?

Miranda Crace7-Minute Read

UPDATED: August 17, 2023

Having multiple debts at the same time can be overwhelming as you juggle various monthly payments and due dates, making it hard to budget your monthly expenses. This happens most often with high-interest credit card debt, which is why some borrowers turn to debt consolidation to simplify their debt repayment.

Let’s break down what debt consolidation is and how it works, and we’ll look at different types of debt consolidation and considerwhen consolidating debt is a good idea.

What Is Debt Consolidation?

Debt consolidation means combining all of your debts – such as medical bills or credit card balances – into a single monthly payment. Consolidating your debt may also give you the chance to lower your interest rate and the amount you owe every month. This strategy could make it easier to pay off your debts faster while saving on interest.

Too many monthly payments?

How Does Debt Consolidation Work?

The most common way to consolidate debt is with a debt consolidation loan. With this type of loan, you use the funds to pay off your existing debt and over time repay the loan amount under new terms. In addition to simplifying your repayment plan, the loan will ideally grant you a lower interest rate.

Debt Settlement Vs. Consolidation

Debt settlement differs from debt consolidation in that it involves negotiation. Some people may hire a company to negotiate with their creditors in hopes of convincing them to settle debts for less than the original amount owed.

With debt settlement, you typically deposit money every month into a special account. Once your balance reaches a certain amount, the debt settlement company will reach out to your creditors and negotiate a lower settlement amount.

The downsides to debt settlement are that you’ll have to make monthly payments, your credit score will take a hit and the debt settlement company will charge you a fee that’s likely 15% to 25% of your total enrolled debt.

Types Of Debt Consolidation

Numerous debt consolidation strategies are available to borrowers who want to simplify their debt repayments. Each strategy haspros and cons, though, so it’s a good idea to review your options and choose the one that best fits your budget and lifestyle needs.

Debt Consolidation Loans (Personal Loans)

You can use a debt consolidation loan to pay off outstanding debt and replace it with a single monthly payment. Ideally, your new loan will have a lower interest rate than your previous debts, potentially saving you money in the long run, too.

Debt consolidation loans are often personal loans from a traditional bank, credit union or online lender. It’s important to note, however, that personal loans often require a minimum credit score for you to be eligible for a lower interest rate, and you’ll likely need a good or excellent score to get the rate you want.

The personal loan application process is relatively straightforward, and once you’re approved, you could receive your funds in 1 – 7 business days. Some lending platforms, including Rocket Loans℠, even offer same-day funding in some instances.*

Home Equity Loans And HELOCs

Home equity loans and home equity lines of credit (HELOCs) are both available for consolidating debt, but both can carry significant risks for borrowers. To secure a home equity loan, a borrower must borrow against the equity in their home – making the home itself collateral. If a borrower fails to make their payments or defaults on the loan, the lender can take the home through foreclosure.

It’s a similar process with a HELOC, but you instead gain a credit line you can borrow from and repay over time. Again, your house is on the line if you fail to make on-time payments.

Balance Transfer Credit Cards

With a balance transfer card, you’re transferring your existing credit card balance debt onto a new credit card with a promotional interest rate that can be as low as 0%. Keep in mind, however, that this method has some drawbacks.

If you go this route, you’ll likely have to pay a balance transfer fee, which will be 2% – 5% of your total balance. Also, after the 12- to 18-month promotional period ends, you’ll be left with a much higher interest rate that may rise as much as 14% – 26%. Compared to a personal loan, a balance transfer may offer more risk than reward.

Student Loan Consolidation

Consolidation for student loan debt involves combining multiple federal loans into a single loan backed by the government, potentially lowering the interest rate and easing the repayment process for many. The process is similar to student loan refinancing, which combines multiple federal or private loans into a single private loan.

When Is Debt Consolidation A Good Idea?

Debt consolidation is a good idea if you feel overwhelmed by multiple debts and can simplify them into one monthly payment with a lower interest rate. It can also be a wise move if you can qualify for the 0% interest balance transfer card and feel confident you can pay off your debt during the promotional period.

Consider also your financial situation. Debt consolidation could be the way to go if any of the following is true:

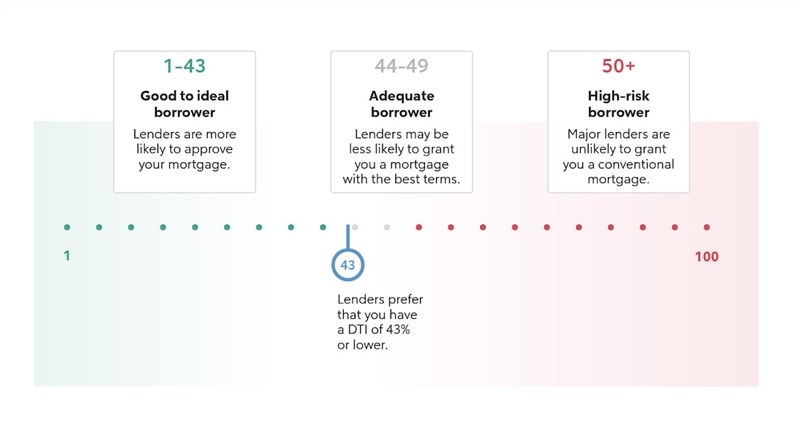

- Your debt-to-income ratio (DTI) is under 36%.

- Your credit score has improved and you can qualify for a better interest rate.

- You have enough cash flow to keep up with your loan payments.

- You can comfortably pay off a loan over a certain period of time.

When Is Debt Consolidation Not A Good Idea?

Debt consolidation isn’t a cure-all, and you could end up running into trouble down the road if you attempt to consolidate debt without strategic planning. Trying to consolidate debt may not be worth it if any of the following is true:

- Your debt amount is small enough to manage.

- Your consolidation options don’t offer a lower interest rate than your current one.

- Additional fees and upfront costs would negate your potential savings.

- You’re struggling to pay back the amount of debt you already owe.

It’s also important to remember that debt consolidation doesn’t address the initial cause of your debt or make it magically disappear. It’s only a simple financing tool that can help you manage your debt and its payments. Therefore, if your debt is the result of careless spending, you can’t count on debt consolidation to improve your financial situation.

Also, if you don’t have too much debt and you believe you can pay it off fairly quickly, debt consolidation may not be worth it.

The Pros And Cons Of Debt Consolidation

Debt consolidation comes with its fair share of benefits and drawbacks. Take a look below at some pros and cons of debt consolidation.

Pros

You can enjoy the following benefits of debt consolidation, depending on your situation:

- A single monthly payment: You’ll be combining multiple debts into a single monthly payment, simplifying your bill-paying process.

- Lower interest rate: You may be able to secure a low interest rate with a debt consolidation option, especially if you have good credit.

- Longer repayment term: A consolidation option can provide a longer repayment term than you had with your previous debts, giving you more time to pay them off.

- Better credit utilization ratio: If you pay off credit cards with a personal loan, you can lower your credit utilization ratio and improve your credit score over time.

- Consistent payments: Personal loans usually come with a fixed-interest rate. So, if you use a personal loan to consolidate debt, your minimum payments will probably be the same each month, unlike with a credit card.

Cons

Debt consolidation can likewise come with a few drawbacks, which include:

- A potentially higher interest rate: Your existing debt might have a lower interest rate than if you consolidated your debt. For example, several student loans might have a lower rate than a personal loan.

- Hard inquiries: Whenever you apply for a loan, the lender will pull your credit history with a hard inquiry. This could drop your credit score by up to five points.

- Extra fees: Lenders may charge you an origination fee for getting a personal loan, or they may add a balance transfer fee on a credit card.

- Collateral requirement: If you choose a secured loan – such as a HELOC or home equity loan – you’ll use your home as collateral and risk possible foreclosure if you default.

- Unchanged spending habits: Your debt could return if you don’t improve your spending habits.

Debt Consolidation FAQs

If you’re still wondering about debt consolidation and whether it’s right for you, learn more about this debt relief option by reviewing the answers to these frequently asked questions.

How long will debt consolidation stay on my credit report?

If you use a loan to consolidate your debt, it could remain on your credit report for up to 10 years after you make the last payment. The hard inquiry your lender makes when you apply for the loan will only stay on your credit report for up to 2 years.

Where can I get a debt consolidation loan?

Many types of lenders offer personal loans for debt consolidation. National bank chains, credit unions, local banks and online lending platforms may have debt consolidation products available.

Is debt consolidation worth it?

You can determine the worth of debt consolidation by comparing the annual percentage rates (APRs) of your current debts to different debt consolidation options. For instance, if your credit card has an APR of 22% but a personal loan would have a rate of 16%, you’d pay less interest with the loan.

Should I consolidate my debt?

If you make on-time payments every month, eliminate or reduce the balance on your consolidated debt and change your spending habits so you don’t take on more debt, debt consolidation could put you on your way to becoming completely debt-free.

Check your credit report and see if you qualify for a lower interest rate. Unless you can get a lower rate than your current one, debt consolidation may do more harm than good to your credit score.

Final Thoughts

Debt consolidation can help streamline your finances by converting multiple monthly debt payments into a single payment, which may have a lower rate and thereby save you money in interest. This strategy isn’t for everyone, though, so make sure to carefully assess your financial situation before committing to a new loan.

If you believe you can benefit from debt consolidation, apply for an online personal loan today with Rocket Loans.

*Same day funding is available for clients completing the loan process and signing the Promissory Note by 1:00 p.m. ET on a business day. Also note, the ACH credit will be submitted to your bank the same business day. This may result in same day funding, but results may vary, and your bank may have rules that limit our ability to credit your account. We are not responsible for delays that may occur due to an incorrect routing number, an incorrect account number or errors of your financial institution.

Apply For A Personal Loan.

Ready To Improve Your Financial Life?

Apply for a personal loan today to consolidate your debt.

Apply For A LoanMiranda Crace

Miranda Crace is a Senior Section Editor for the Rocket Companies, bringing a wealth of knowledge about mortgages, personal finance, real estate, and personal loans for over 10 years.

Related Resources

Viewing 1 - 3 of 3